Shopify Ecosystem Consolidation

I've been actively involved in E-commerce for a few years now, and one of the most impactful trends I'm seeing is consolidation among the apps and services used by merchants.

It's a sign of a maturing market, and virtually every industry goes through the process. Consider automotive: the large number of manufacturers in decades past has become just a few large conglomerates like Toyota, Ford, GM, Kia/Hyundai, etc. For the first time in decades we have several upstarts due to the electric paradigm shift, but even those will likely consolidate over time.

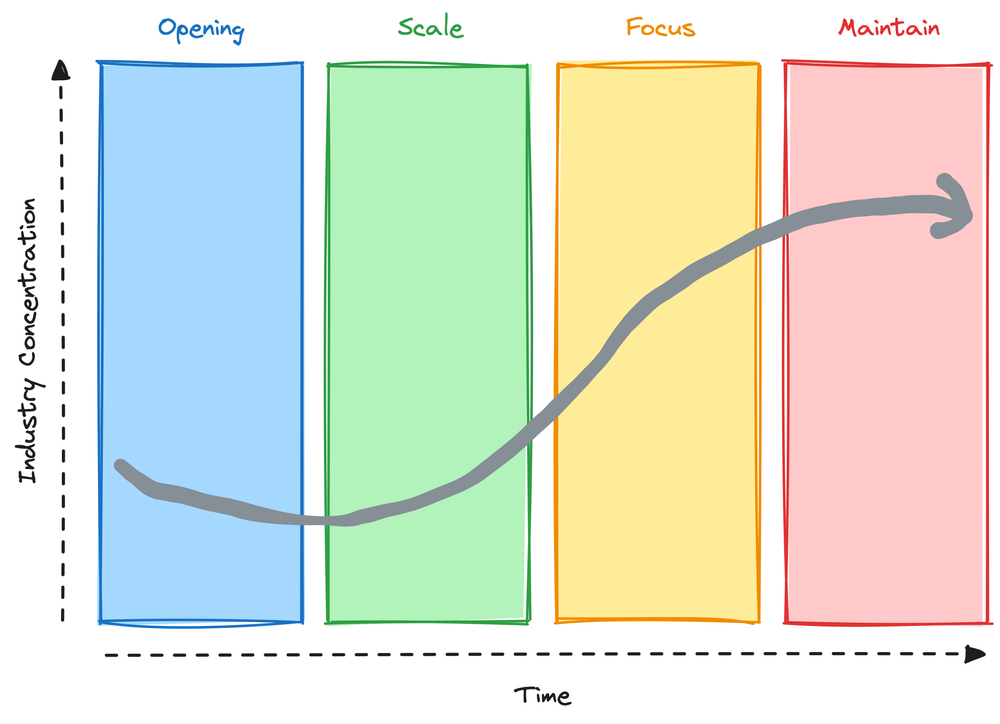

The Harvard Business Review covered the topic of consolidation more than 20 years ago, and the phenomenon is well discussed in business and economic circles. While the consolidation of apps used by e-commerce merchants is different than the consolidation of multi-hundred-billion dollar industries, a lot of the same principles apply.

Why Consolidate?

It its core, there are a handful of driving factors behind app consolidation:

- Merchants don't want to have a huge number of apps installed on their store. Each app has overhead. This overhead can show up in the form of billing, site speed impacts, security concerns, or just the burden of needing to scroll through a huge list of apps anytime you want to accomplish something.

- Some apps just aren't very high quality, and will languish over time when they don't gain traction. There are dozens of shipping protection apps on the Shopify App Store for example, but only a small handful have the features, stability, and service behind them to gain traction with merchants.

- A lot of Shopify apps have functionality that is directly adjacent to other apps. An easy way to increase your market share is to expand the feature set of your app. If App A can add all the functionality of App B, then all of the customers of App B are added to the total accessible market for App A.

- Sometimes a unified solution can offer advantages that separate apps can't. Take package tracking + shipping protection, for example. Getting updates on your package delivery in the same place that you can file a claim because your package didn't arrive is more powerful than needing to perform those in completely different places.

Types of Consolidation

There's a few different types of consolidation at play in the Shopify ecosystem.

Acquisition

Several different groups are working to acquire Shopify apps under a few different strategies.

WeCommerce and AppHub are two of a few companies that are attempting something similar to a private equity type play in the Shopify app ecosystem. These companies have taken funding, and are spending millions of dollars to acquire various apps. These aggregators aren't necessarily looking for economies of scale or synergies, they are looking to combine experience and customer bases (and profits!) with these independent apps.

Other groups have taken a different approach, where they acquire complementary apps with the explicit intent of providing a unified experience between them all. In the transportation space, think of Uber buying Drizly and Postmates to provide new services with the same driver network. In the Shopify app space, Aftership started as a tracking app but has expanded in new directions to bolster a post-purchase strategy.

Feature Extension

Having an app extend its feature set is a very common approach to consolidation.

Think back to some of the early SMS marketing apps. They all added emails along the way since it was a pretty easy extension of their platform. Naturally, all the email-based marketing providers added SMS along the way too.

Some shipping protection providers added package tracking, and then they tried to build an independent marketplace and product aggregator. (No, that one didn't work very well).

Package tracking providers are investing deep into logistics analytics, real-time delivery estimates, and push notifications.

Returns platforms are implementing tracking, and coming up with new revenue models.

Helpdesk ticketing systems are adding conversion tools.

All in all, the consolidation stage is just starting to heat up with this approach. All these different apps are trying to move into adjacent categories, and provide the most value to retain customers while expanding their market to gain new customers. Not every app can do everything - so there will definitely be winners and losers as this stage progresses.

Integration

As apps try and expand their use case, and as apps try to protect against others encroaching on their territory, integration will be a first line of defense.

If two apps have complementary functionality, an effective way to offer a compelling unified value is to integrate different solutions together. This allows the two apps to build mutual value without each one needing to build out the entire functionality of the other app. This requires APIs and other integration points though, and might be challenging for some apps to implement for various reasons - especially if they don't have a strong technical foundation.

Some apps act as strong focal points for integration. Helpdesk apps such as Gorgias tend to be centralized locations for a lot of customer touchpoint, so various apps find it advantageous to integrate. Returns, shipping protection, and tracking are all examples of functionality that may prompt a need for customer service - and the integrations can build a lot of mutual value.

Consolidation Countertrends

While consolidation is a major trend in the Shopify ecosystem, the number of apps grew for a long time. While the sheer quantity of apps keeps growing, the revenue (and mindshare) is locked in to a small number of apps at the top.

The trends here are similar to what we saw with the Apple App Store in the past. Those who were developing apps when the store launched were able to be seen directly by customers, and it was relatively easy to stand out from the rest of the crowd. Nowadays, you can't just build a good app and be successful - most mobile apps are either part of a larger business, or there is a lot of marketing and development dollars behind them to make them visible to the masses.

One of the strongest drivers of the trend behind the increasing number of apps is that Shopify has been extending their developer API's over time, creating more opportunities for apps to more easily .

A great example of this factor is subscriptions. For a very long time, doing subscriptions required various "hacks", such as having all information about the subscription exist outside of Shopify and redirecting to proprietary checkouts at the time of purchase. There was a single market leader at that time (Recharge), but once Shopify supported subscriptions natively within their API's, there was an explosion of subscription providers. There were new providers that jumped in (like Skio), but existing apps (like Yotpo) followed the feature extension path to add subscriptions to pre-existing apps as well.

Shopify added some returns-focused API's recently as well. There have been some historical market leaders in the space, but others have jumped in now that it is easier to build a returns application. At Corso, the predecessor to Crew (our returns, exchanges, and warranties app) was built before any of the current returns APIs were made available. As those API's have been released though, we have been able to iterate and extend our features that much faster.

Lastly - as a countertrend to the countertrend, it seems that the number of apps in the App Store has actually started decline in the last few months. There's only so many different types of apps you can build. Given the effort it requires to keep those apps up-to-date with API's and requirements changing all the time, some of the apps are bound to drop out when the effort to maintain them doesn't outweigh the benefit gained.

Shopify benefits by offering choice to their merchants - so the trend of making things easier for more developers to create competing apps will undoubtedly continue.

The Corso Perspective

At Corso, we believe that consolidation is the future. As a leadership team we do our best to try and peer around the corner and anticipate where current trends will take us, and to understand what will be the most attractive to merchants.

Interestingly, Corso has participated in all 3 of the consolidation plays mentioned above!

Our Starting Point

Our mission at Corso is to provide the best Post Purchase CX platform available.

We started out when we realized that there was a massive gap in the market for a merchant-first, service-focused shipping protection solution. We wanted to provide customer service at levels that would rival what the brand themselves could do, and we wanted to promote the brand identity rather than our own during the process. Merchants see measurable increases in profitability when they use Corso, which proves out our "merchant first" strategy in a way that nothing else could.

We brought on some amazing team members who helped us build the greatest customer service team in all of e-commerce. The team understands how to work with the customers of the largest brands out there, and achieves a 98% customer satisfaction score and more than 6,000 5 star reviews. And that's while dealing with passengers who have had their order lost, stolen, or damaged!

Acquisitions

We always knew that shipping protection was nothing more than an entry point, a launchpad for our next steps. Not long after launch, we acquired a returns app. We built that app out to include functionality for returns, exchanges, warranties, and more - launching Crew by Corso as the final product.

Shipping protection together with returns, exchanges, and warranties started to make our product look more like a platform. We realized the power of positioning our software and our services as a solution for everything that could happen with the customer after the sale, and becoming a post-purchase customer experience platform.

Features

The Corso product and engineering teams are always hard at work on new things. Since launching we've added some major features native to a returns platform, including things like automations and analytics.

We have also added new, non-core features like package tracking. Merchants can use the Crew app to embed an entire tracking and returns portal inside any page on their Shopify site for example, a unique consolidation point we offer.

Integrations

Possibly the most important part of the Corso strategy is integrations.

While we offer basic package tracking as an app, there are companies such as Wonderment and Malomo who do it better than we ever will.

We aren't interested in managing subscriptions, but we know how important the post-purchase experience is for those customers. As a result, we integrate with Recharge and Skio, and almost all other subscription apps.

Customer service ticketing systems are a key part of the post-purchase customer experience, but it's not a core set of functionality we will build. Instead, we offer integrations with the likes of Gorgias, Zendesk, and Gladly.

There's WMS's, shipping platforms, address validators, customer retention systems, and more that Corso integrates with. In some cases there may be overlap with what we do, but outside of a few core elements Corso aims to integrate and collaborate more than we aim to build out a best-in-class solution ourselves.

By partnering with other complementary apps, we can provide mutual value in a way that encourages merchants to use both of our solutions.

Takeaway

So, what do you need to know in the face of this consolidation? It depends on your role.

Are you a merchant? Look for apps that condense a lot of functionality together. Pick the best of breed in your apps, and don't compromise - but if an app does what you need in a few categories, why not take advantage of the consolidation trend by consolidating the apps in your store?

Are you an investor? Keep an eye on the apps that stand to gain or lose the most through consolidation. The nimble apps that can pivot, and which are positioned to grow in adjacent directions, are the ones that stand to grow the most. Pair that with genuine value being provided, and you have a recipe for growth. It remains to be seen if the rollup strategy will prove out - but looking for synergies between apps could prove advantageous.

Are you an app developer? Look for opportunities to grow your functionality in complementary directions. Acquisitions are tricky for a lot of reasons and generally shouldn't be a first choice for a way to expand functionality, but integrations are often straightforward and don't require a lot of up-front investment.

As in any industry, keeping an eye on Shopify App trends can prove advantageous. wether you are a merchant, an investor, or an app developer, understanding the industry consolidation that is just starting can give you a leg up as you compete.